The year 2024 was a record-setter for the state of Nebraska, which was projected to exceeded over 2 million people in population. At the same time, the U.S. Census Bureau has estimated the population of Omaha proper fell by 2,716 from 2020-2023, a -1.7% change.

What is the future of Nebraska's most populous city, and the state as a whole? Here are a few key figures that lay out changes over the past few years.

In the last quarter of 2024, unemployment in Omaha slightly decreased, from 3% in October to 2.8% in December. Out of the 509,000 people in the labor force, 14,300 are unemployed, according to the most recent numbers from the U.S. Bureau of Labor Statistics.

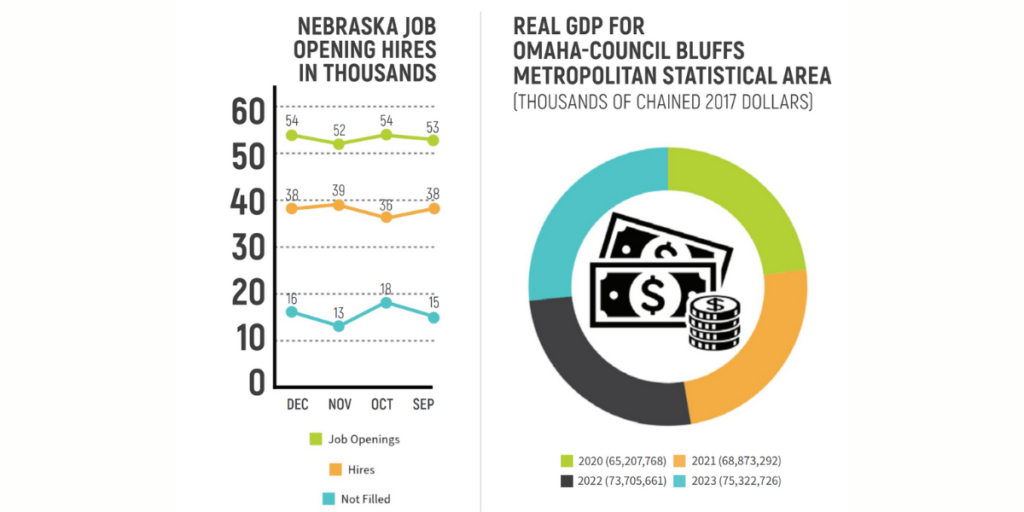

Across Nebraska, there were at least 52,000 job openings each month from September-December 2024, with monthly hiring falling short by at least 13,000 workers. October 2024 had over 18,000 jobs not filled.

Degrees conferred at any level rose, then dipped, from 2019-2023 across finance, health care, transportation, information technology, education, and agriculture. The 2021-2022 academic year saw 18,920 graduates across all these sectors, with the most recent data collected, for the year 2022-2023, shows 17,576 degrees were granted—a 1,344 decline.

The sectors with the most degrees awarded in that period were finance (23,772), health care (23,530), and education (13,996); those with the fewest degrees awarded were IT (5,995), agriculture (3,961), and transportation (598).

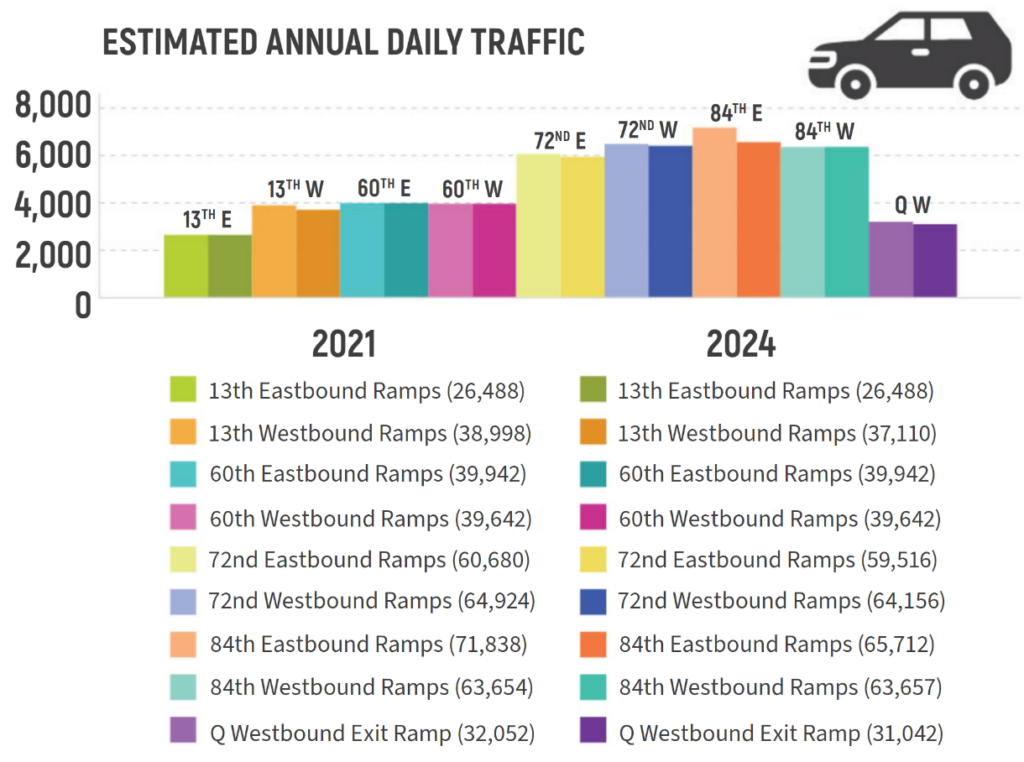

Traffic along major I-80 entrance and exit ramps has remained stable, with some variances. Using the Estimated Annual Daily Traffic metric by the City of Omaha, the entrance and exit ramps on 72nd and 84th streets were the busiest in 2024, with 84th Street having an estimated average of 65,712 vehicles passing through it daily.

The busiest intersections were within the city, whereas the intersections at the city outskirts had the least amount of traffic, with the entrance at Irvington Road and Ida Street having 10,594 estimated vehicles passing daily.

The Omaha metro’s GDP has been growing positively, indicating steady economic expansion. From 2020-2023, Read GDP grew 15.5%, from $65,207,768 to $75,322,726 in 2017 dollars. The years 2021-2022 had the highest rate of growth with a 7% increase, and the years 2022-2023 had the lowest rate of growth at 2.2%.

Using the FDIC’s most recent Nebraska state profile, the banking industry remains stable with increasing profitability. There are 148 total banks in the state with $109.7 billion in assets. Past-due and delinquent loans rose from 0.41% in Q3 2023 to 0.59% in Q3 2024. Banks are benefiting from high interest rates, with a net interest margin of 5.69% in Q3 2024, up from 3.9% in 2022.

Among industries, agriculture has the highest loan concentration based on the median % of Tier 1 Capital plus the reserve for loan and lease losses. At 213% in Q3 2024, this means banks have lent over twice their core capital and reserves to this sector. This indicates a high interest and confidence in agriculture among banks across the state.

Sources

United States Census Bureau, Quick Facts, Nebraska | United States Census Bureau, Quick Facts, Omaha city, Nebraska | City of Omaha Public Works, Traffic Information Center, reports from 2021-2024 | FDIC State Profile, Nebraska, Third Quarter 2024 | U.S. Bureau of Labor Statistics, Midwest Information Office, Nebraska Job Openings and Labor Turnover — December 2024 | US Bureau of Labor Statistics, Midwest Information Office, Omaha-Council Bluffs, NE-IA Economy at a Glance, accessed March 1-2, 2025 | Nebraska’s Coordinating Commission for Postsecondary Education, Degrees and Other Awards Conferred by CIP Code 2019-2020 - through 2022-2023 | Bureau of Economic Analysis, U.S. Department of Commerce, CAGDP9 Real GDP by county and metropolitan area, Omaha-Council Bluffs, NE-IA (Metropolitan Statistical Area), 2021-2023

This article originally appeared in the April/May 2025 issue of B2B Magazine. To receive the magazine, click here to subscribe.